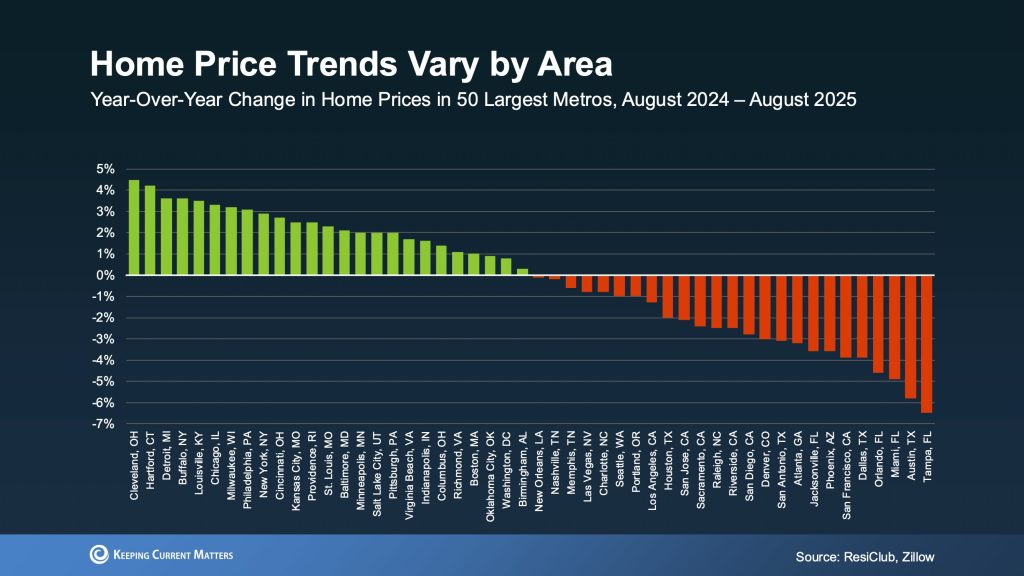

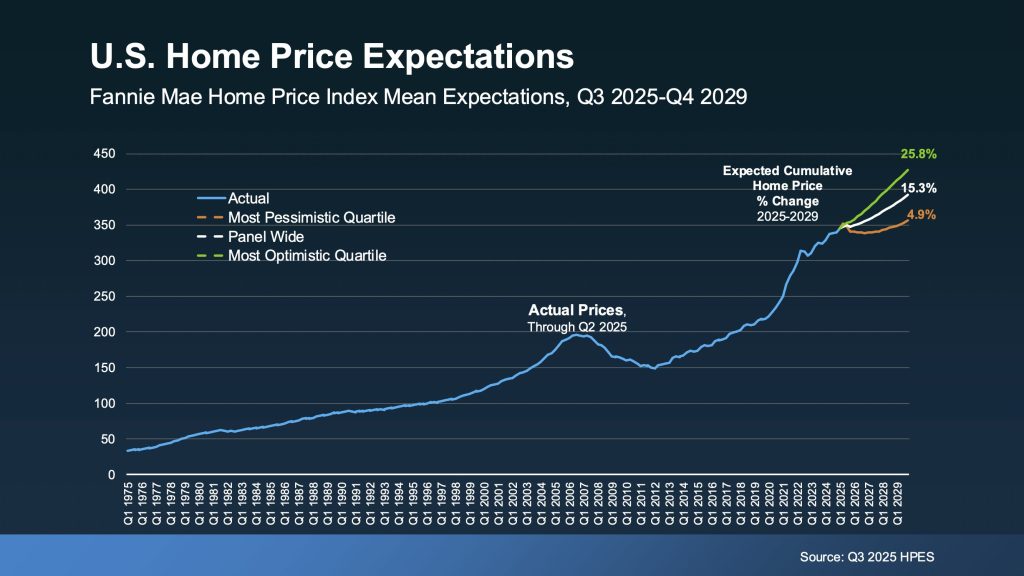

I’d love to help you understand the trend in your specific neighborhood and what it means for you.

If you want the real story about what home prices are doing in our area, let’s connect.

Call or Text me and connect today!

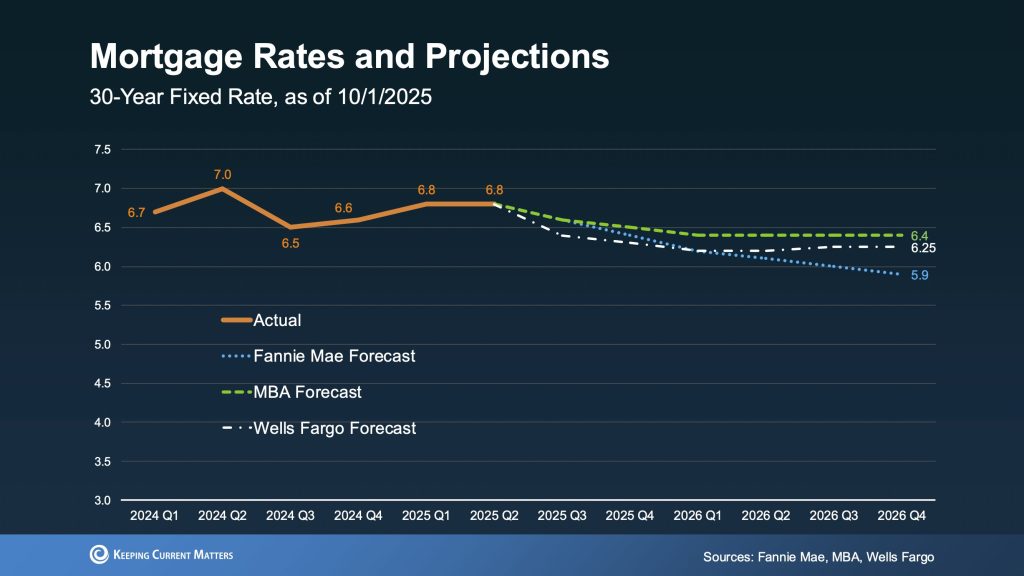

Here’s a quick look at where mortgage rates stand this week.

As of Monday, October 13th, 2025, these numbers come from David Kammerer with Summit Funding. Dave’s a Senior Loan Consultant licensed in many states — from the Pacific Coast all the way to Florida — and you’ll find his contact info in the show notes if you’d like to connect with him or his team. Summit Funding 541-868-1850 Email Website

Now, for well-qualified borrowers with high credit scores, here are the current averages:

- Conventional loans:around 37%

- FHA loans:about 10%

- VA loans:12%

- USDA loans — currently on hold until the government shutdown program receives funding again.

Dave mentioned that rates are pretty similar to last week, but there are still several international factors developing that could cause some movement in the mortgage-backed securities market. He’ll keep us posted if anything significant changes.

And just a quick reminder — if you’re running into any challenges with financing, reach out to Dave or your trusted mortgage lender. There are alternative loan programs out there that might help you move forward in the near term.

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

We believe every family should feel confident when buying and selling a home.

Keeping Current Matters, Inc. © 2025